Some things don’t have to change. We are who we are. Thank god.

While this pandemic will prevent us from marching down Market Street in colorful mass to mark the 50th anniversary of the first Pride parades held in San Francisco and New York City, it does not prevent us from coming together to celebrate ourselves, our hard-fought achievements, our rampant creativity, and our strength in community.

(As published in the San Francisco Bay Times, May 21, 2020)

On the contrary, it should inspire us to do so regardless – safely, of course, with smart adherence to in-person social distancing guidelines, and plenty of aplomb.

I have long admired my good friends Donna Sachet and Gary Virginia—the most dynamic of duos—giving, doing, organizing, giving, convening, inspiring, doing, (did I mention giving?), entertaining, celebrating, and bringing it over and over again in big and small ways to meet community needs. So, I am not surprised that they will outdo themselves again this year.

Their legendary Pride Brunch—the event of the season—will go on, June 27th, and everyone is invited!

From the comfort of your living room, kitchen, or dining room, Gary and Donna will bring you the Grand Marshals of the Pride Parade at high-noon on Saturday June 27th, honor the rich history of LGBTQ culture and liberation, and celebrate 50 years of San Francisco Pride with a saucy kitchen battle. The two will share their favorite brunch recipes and you will be the judge yourself, crowning the winner “Pride Brunch Queen.”

From the comfort of your living room, kitchen, or dining room, Gary and Donna will bring you the Grand Marshals of the Pride Parade at high-noon on Saturday June 27th, honor the rich history of LGBTQ culture and liberation, and celebrate 50 years of San Francisco Pride with a saucy kitchen battle. The two will share their favorite brunch recipes and you will be the judge yourself, crowning the winner “Pride Brunch Queen.”

We can sit back and relax with hosted cocktails and a delicious brunch delivered right to our respective doors. Or you can dance, parade, and sing along to live entertainment, live auctions, and special surprises in the privacy of your own home. This longstanding PRC fundraiser honors individuals and organizations fighting for LGBTQ equality, while raising critical dollars for PRC’s lifesaving services like legal advocacy, emergency financial assistance, residential treatment, and employment services.

Celebrating 50 years of San Francisco community Pride, parading, and action, it is hard to believe how far the LGBTQ movement has come since the Stonewall riots erupted, awakening a new generation of legal and social advocacy. In retrospect, this turning point brings new lessons today amid this evolving era of worldwide COVID-19 public health emergency. We are all connected, and we are stronger when we stand together.

As public consciousness is rising about that interconnectedness and our Country’s glaring health, income and access inequities, I am proud of San Francisco, our LGBT and allied communities. We’re on the frontlines, showing up for the most vulnerable again and again. And while there is still plenty of work to do, I look forward to celebrating the contributions and opportunities brought by this year’s Grand Marshals—The LGBT Asylum Project, Founder of the Spahr Center Rev. Dr. Jane Spahr, and Executive Director of the LGBT Historical Society Terry Beswick—at this year’s virtual Pride Brunch.

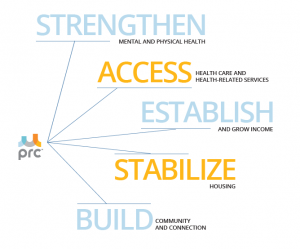

PRC, Pride Brunch’s beneficiary, has long fought for the most disenfranchised and health-challenged in our community on the frontlines of HIV/AIDS and LGBTQ advocacy for access to basic and critical resources. Today, these efforts are even more important as the impact of longstanding fissures in health status and experiences by race, geography, income, and identity are laid bare by the novel coronavirus. PRC is providing emergency funds for rent, medication, and connectivity; legal advocacy to preserve healthcare and subsistence income through job loss and upheaval; and emotional support and employment services to keep people moving forward; while also sheltering nearly 300 adults in place through a substance use and mental health treatment continuum prioritizing health, safety, and wellness.

As a 55-year old African American gay man, I am both deeply familiar with the disconnection between legal equality and lived equality and deeply indebted to the collective advocacy of so many courageous individuals who were willing to hold the line, never back down, and stand in harm’s way. So, let’s come together on June 27th and celebrate what’s good and great about San Francisco Pride.

Inspired again by Gary and Donna, I think the dire issues of the day will continue to galvanize us – a Inspired again by Gary and Donna, I think the dire issues of the day will continue to galvanize us – a stronger, even more compassionate community. I choose joy, love, honesty, empathy, compassion and service along with a hint of leather, lipstick, and humor. So, let’s brunch!

Inspired again by Gary and Donna, I think the dire issues of the day will continue to galvanize us – a Inspired again by Gary and Donna, I think the dire issues of the day will continue to galvanize us – a stronger, even more compassionate community. I choose joy, love, honesty, empathy, compassion and service along with a hint of leather, lipstick, and humor. So, let’s brunch!

How could we not celebrate Pride’s 50th anniversary. I’m already planning my outfit. Don’t miss the Battle of the Queens, Gary Virginia and Donna Sachet’s legendary Pride Bruch, streaming live at 12pm on June 27th. Tickets are on sale, so get yours today, and prepare to give big. See you there.